How we built an estate administration software platform.

Our biggest assets? Ears.

In my last newsletter, I shared the story behind The Australian Probate Report 2025 and mentioned spending more than 200 hours speaking with wills and estates solicitors.

Most of this time was with the practitioners and clerks who made up the Vale Expert Advisory Panel on Digital Estate Administration.

For a profession with a reputation for billing in 6-minute increments, the generosity we received from our advisory panel was astounding.

Building a software platform to streamline estate administration wasn’t something we did on our own. The wisdom of this incredible community of probate experts has turned Vale from an idea into a trusted software platform that’s transforming the way estate administration is done.

If you’d like to see what we’ve been working on, click below to join our waitlist.

Waitlisted firms receive free access to Vale for all your matters until 2026 and a host of other perks.

The Vale Journey

The journey to streamline the estate administration process was originally a means to an end: to avoid having to complete yet another Link Market Services Share Transfer form.

But I received some foundational pearls from a mentor right at the beginning:

Don’t build in silence, and don’t build just for yourself. You need to talk to people and build something others want!

Fantastic advice.

Reaching out

I reached out to Tara Lucke and asked if she’d put a call out in The Art of Estate Planning Facebook group.

Within days, a small group of regional, suburban and city-based firms had volunteered to help map the probate journey, in all its n all its minutiae, nuance, and frustrations, from start to finish.

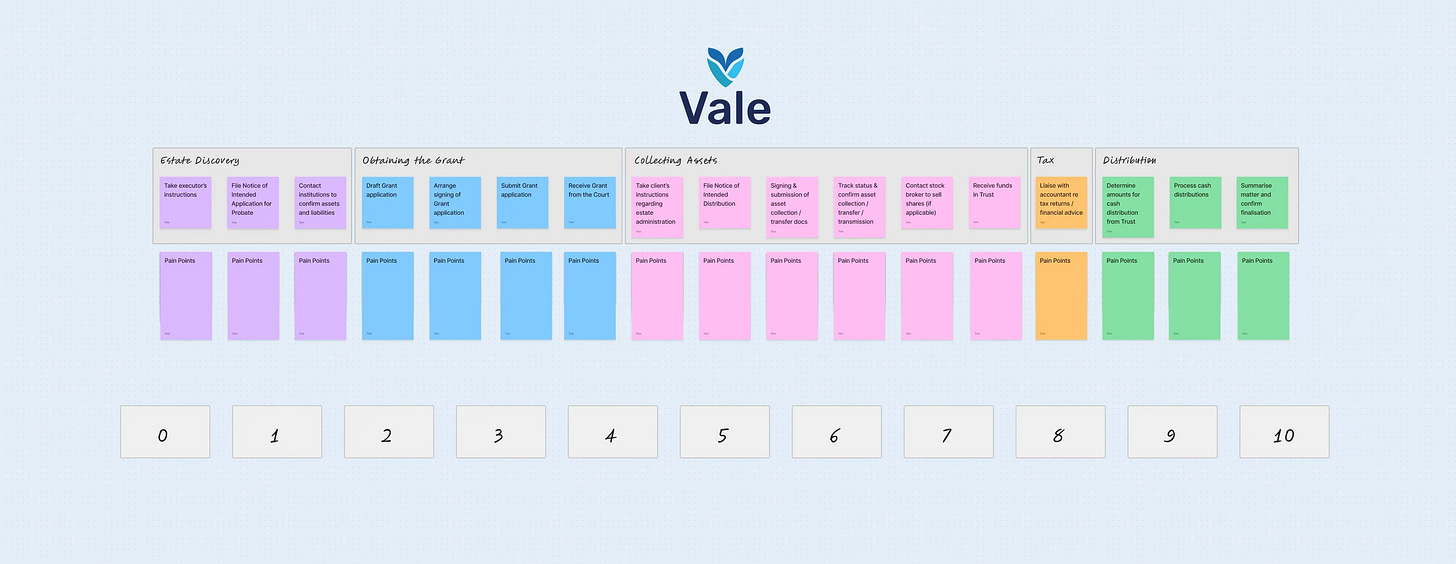

In our initial meetings, we shared a stack of digital cards in an online collaboration workspace on FigJam. The workspace started out like this:

We needed to understand the procedural and jurisdictional nuances that practitioners between all firms and across all states and territories experience daily.

We asked practitioners to identify and rank their most significant pain points on a scale from 0 (painless) to 10 (extreme pain).

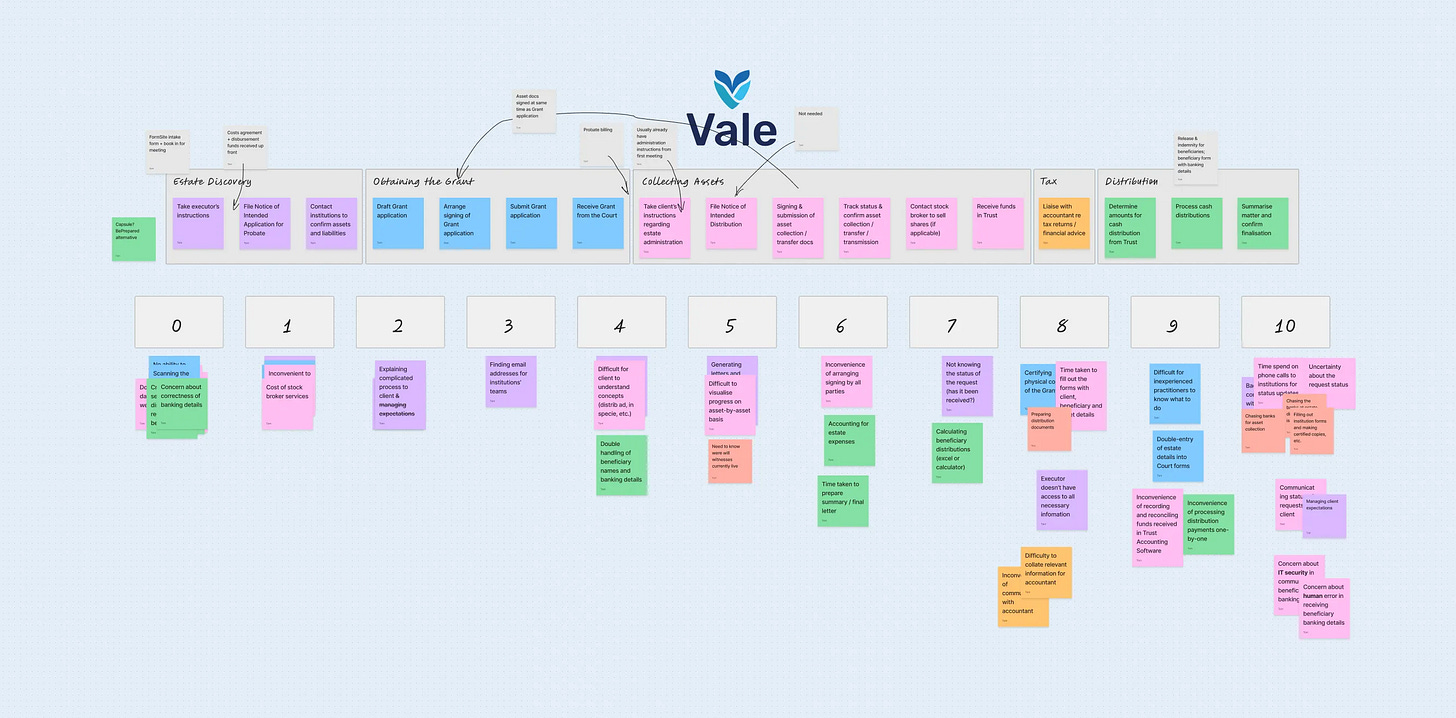

At the end of the session, the workspace looked something like the image below:

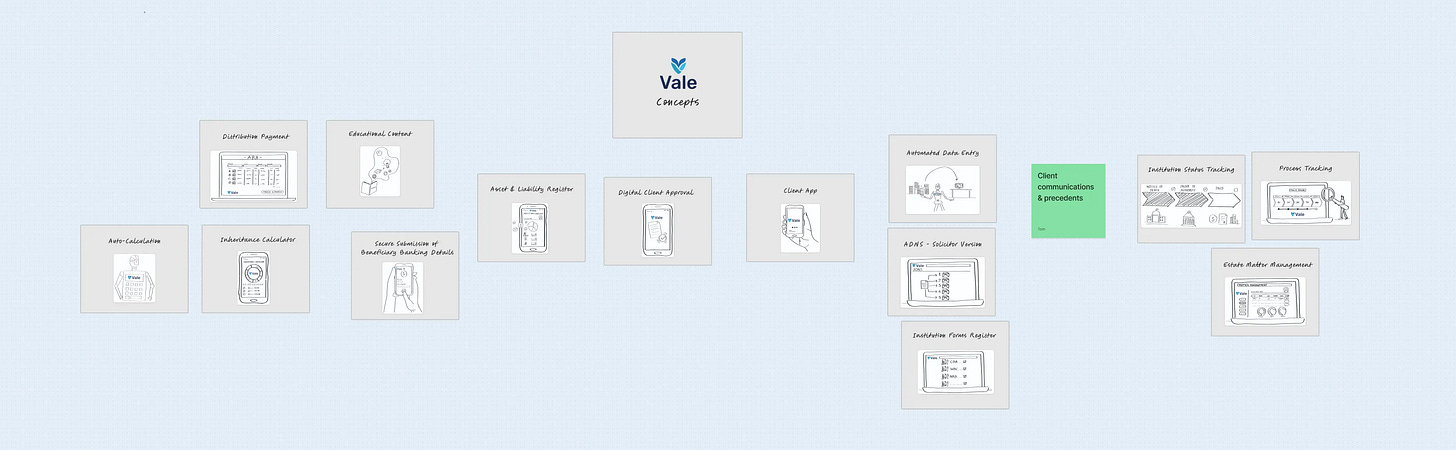

We presented a collection of ‘pain-killer’ concepts, asking the lawyers to order our suggestions from least appealing (left) to most appealing (right).

Here’s an example of what they came up with:

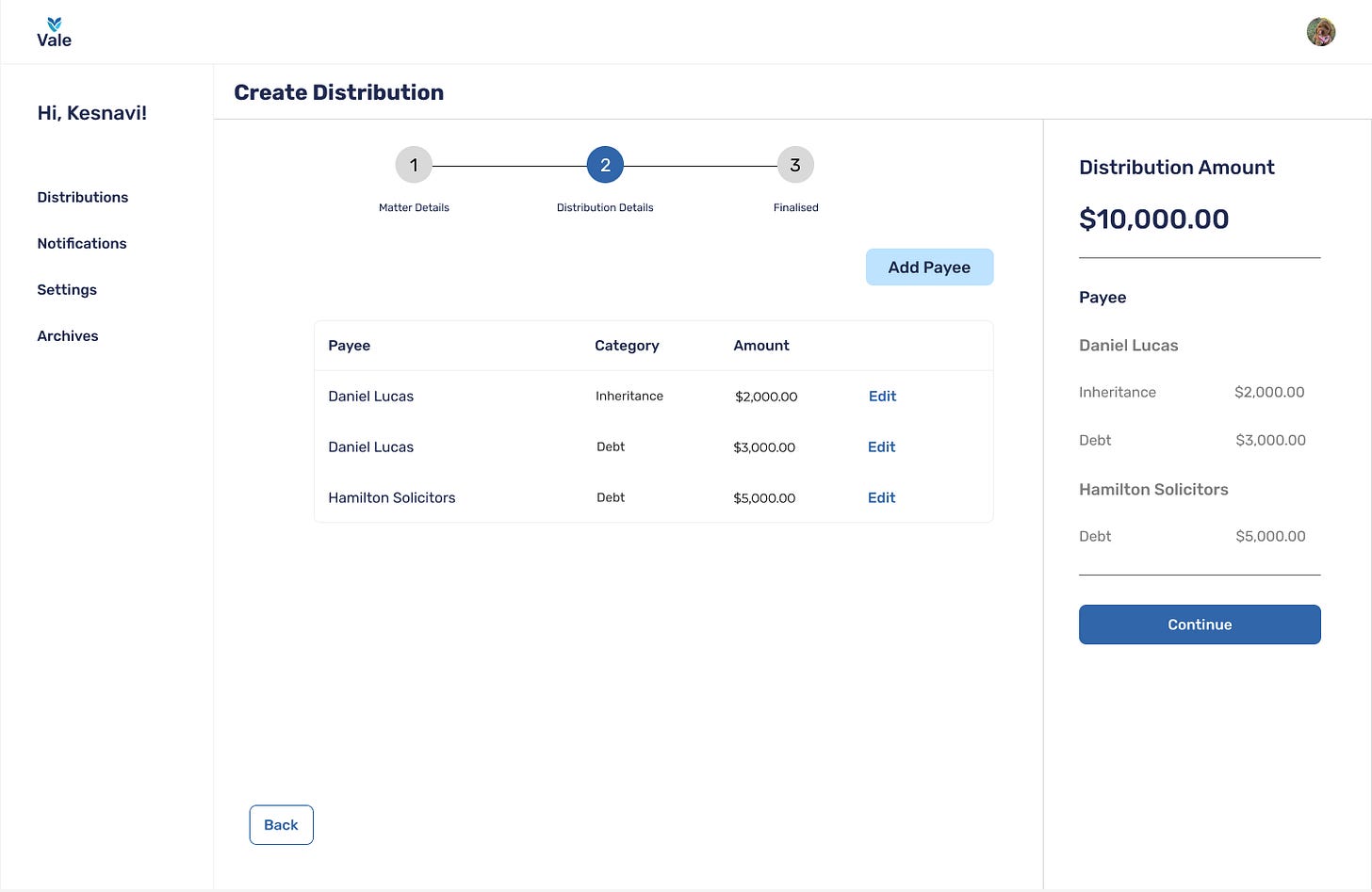

We learned that practitioners’ main frustrations fell into two broad areas:

Managing relationships with institutions: banks, super funds, share registries, aged care providers, etc: each with its own forms, requirements, and delays.

Managing relationships with beneficiaries: coordinating distributions, managing expectations, and ensuring funds flow predictably and securely.

Our advisors described everyday obstacles in detail: banks with seven different probate thresholds and twenty-five different forms; super funds insisting on original paper documents mailed to processing centres; share registries rejecting correspondence because of a slight difference in date format. Some institutions lost correspondence entirely; others took months to respond. The worst story we heard was of a deceased estate with 80 issuer-sponsored shareholdings, to be transferred to 5 beneficiaries. The practitioner spent his weekend preparing 400 hard copy share transfer forms.

It’s certainly difficult to deliver transparent, reliable services for clients when no-one knows if a financial institution will take three days or three months to respond to a discovery letter.

The Prototype (learning the hard way)

After these initial interviews, we thought we understood what people wanted.

So we designed a product.

Everyone was excited.

Until we realised that what we’d only digitised estate administration in theory.

To make this system work, we’d need buy-in from every financial institution in the country—and we weren’t prepared to wait until 2035 to see real changes. We saw client expectations shifting far quicker than that!

So we took what we had learned in our interviews and began building in increments.

Vale’s first prototype was a distribution tool—a way for firms to generate bulk payment files to help make beneficiary distributions more efficient. It worked beautifully, and nobody bought it.

Lawyers had told us in expert detail what needed fixing, and we’d even created a tool that worked. But it didn’t fit into lawyers’ workflows.

Our prototype is a fine example of what happens when you stop talking to users.

We needed to find a way to be closer to the profession and be sure that we were building something others want.

The Vale Expert Advisory Panel on Digital Estate Administration

Having learned our lesson, we reached out to a group of accredited specialists, leading wills and estates practitioners and probate clerks across Australia, and asked for help.

This led to the establishment of Vale’s Expert Advisory Panel in early 2024.

Over the following months, we met fortnightly with more than forty wills and estates lawyers from a wide variety of firms. In each session, our team shared new designs, concepts, and prototypes for review. The feedback was candid and forensic.

After five successive proofs-of-concept, more detailed patterns began to emerge. Our advisors’ collective insight converged around some important priorities:

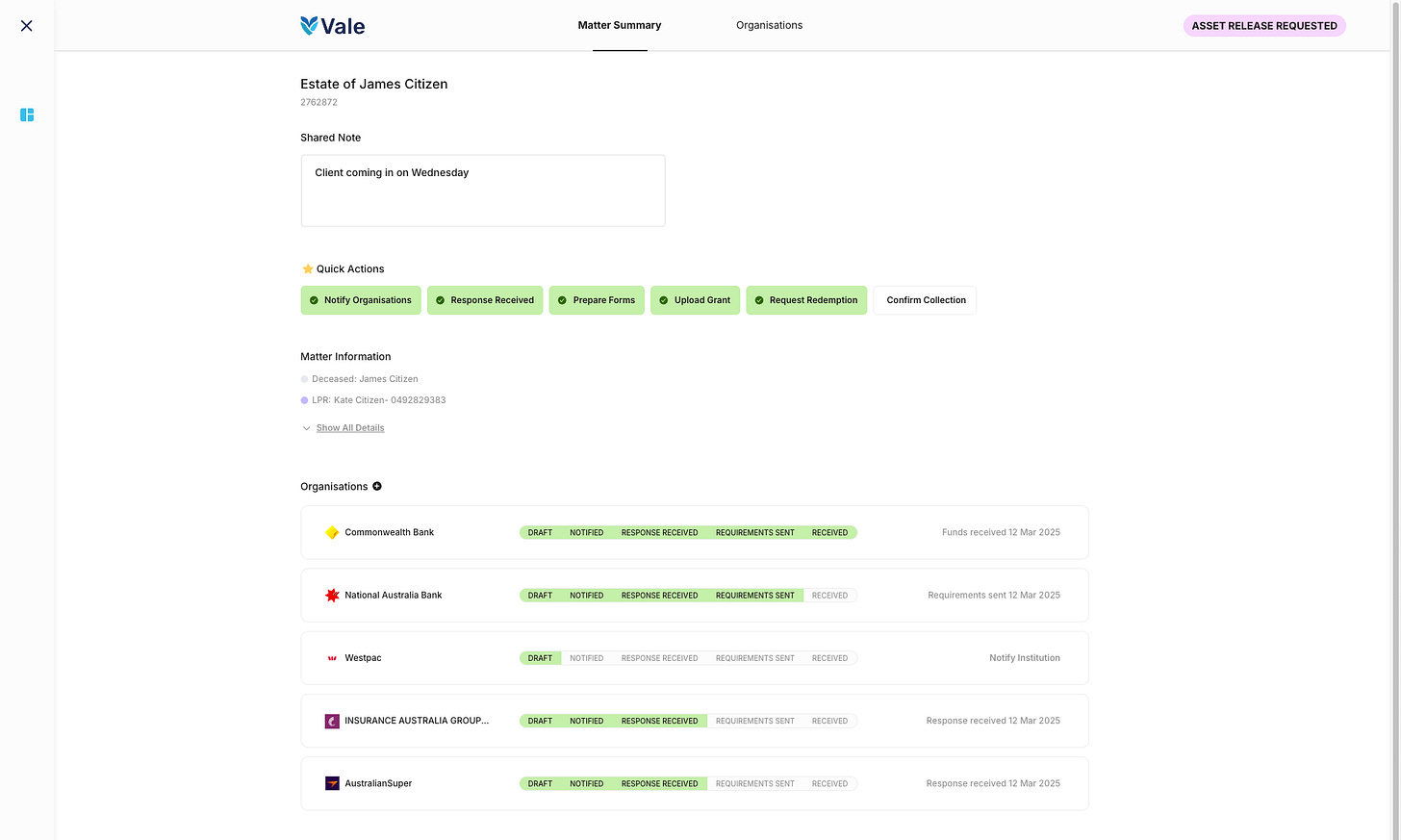

Simplicity: None of our advisors had got into probate practice to become expert form-fillers. The administrative layers—dozens of duplicative letters, inconsistent institutional requirements, and manual data entry across multiple portals—were exhausting and consumed time everyone wished could be spent on legal reasoning and client care. There was a clear need for a system that stripped away the noise so practitioners could focus on their core work.

Efficiency: Our advisors described spending hours re-entering the same information into different bank or superannuation forms, or chasing institutions that rejected applications over trivial formatting inconsistencies. They wanted tools that could reduce the cognitive and time load of these processes, ideally through automation, access to templates, and the centralisation of institutional requirements more broadly in a single place.

Communication: We learned that one of the hardest jobs in probate practice wasn’t managing the work, but managing client expectations. Clients almost always feel lost in the process and in the dark about what’s happening or how long things will take—especially when external delays are unpredictable. Our advisors wanted better ways to keep clients informed, confident, and calm through the process. We thought real-time matter-tracking could be a game changer for clients and practitioners alike.

Integration: Above all, our advisors felt like they were juggling a whole host of differently sized and differently weighted balls. Estate administration is fragmented across banks, share registries, super funds, court portals, executors, beneficiaries and others, with little interoperability in between. The profession didn’t need another system that would end up feeling like another ball had been introduced to the mix—it needed a system that felt like an extra pair of hands.

This convergence of needs became Vale’s blueprint.

How Vale Builds

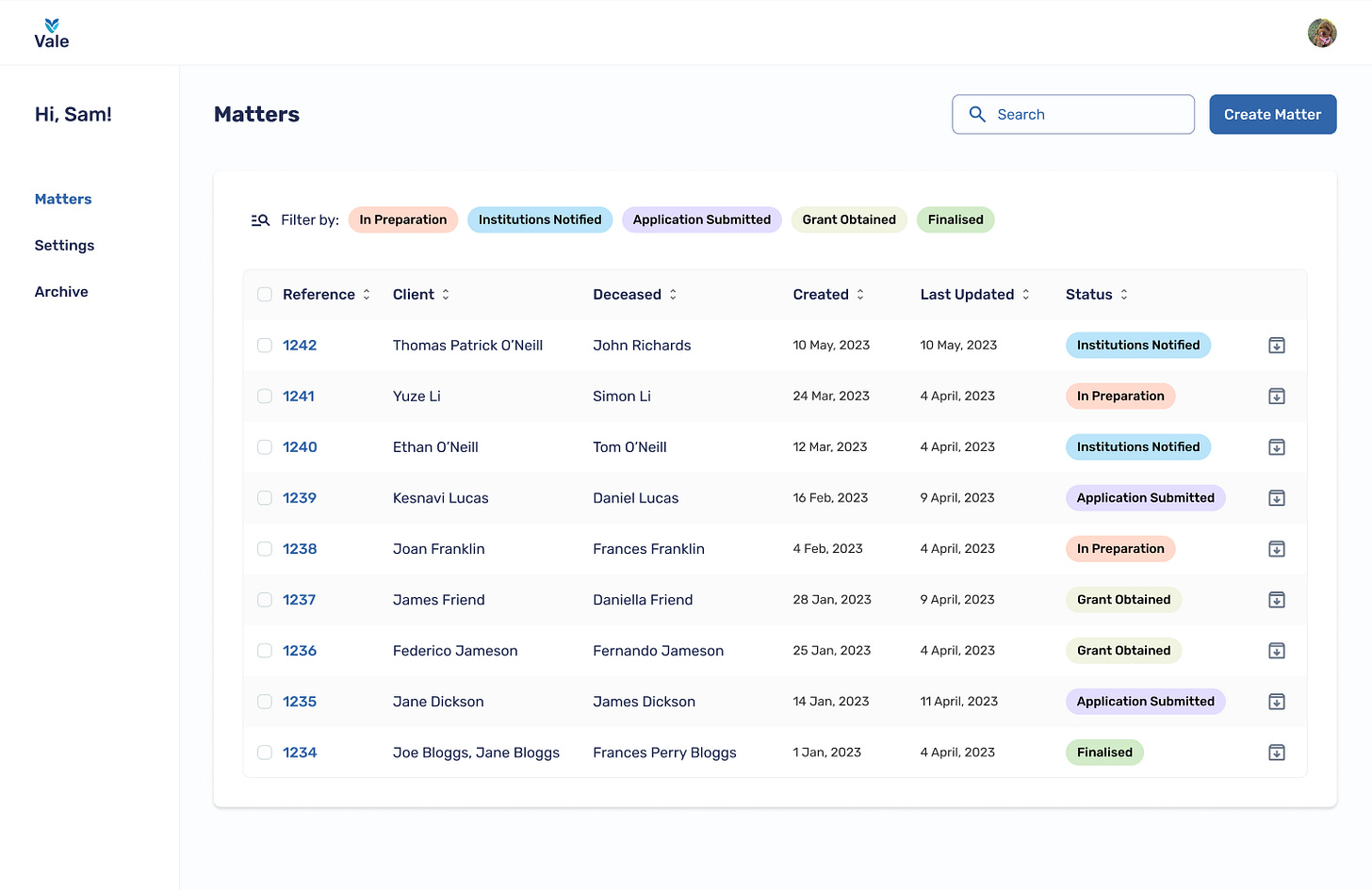

At the end of 2024, we released Vale’s first minimum viable product (MVP) inviting a small group of firms to start using it in real matters. Some feedback was gentle, some was brutal, but all of it was gold. Every comment and every suggestion nudged the design closer to what it needed to be.

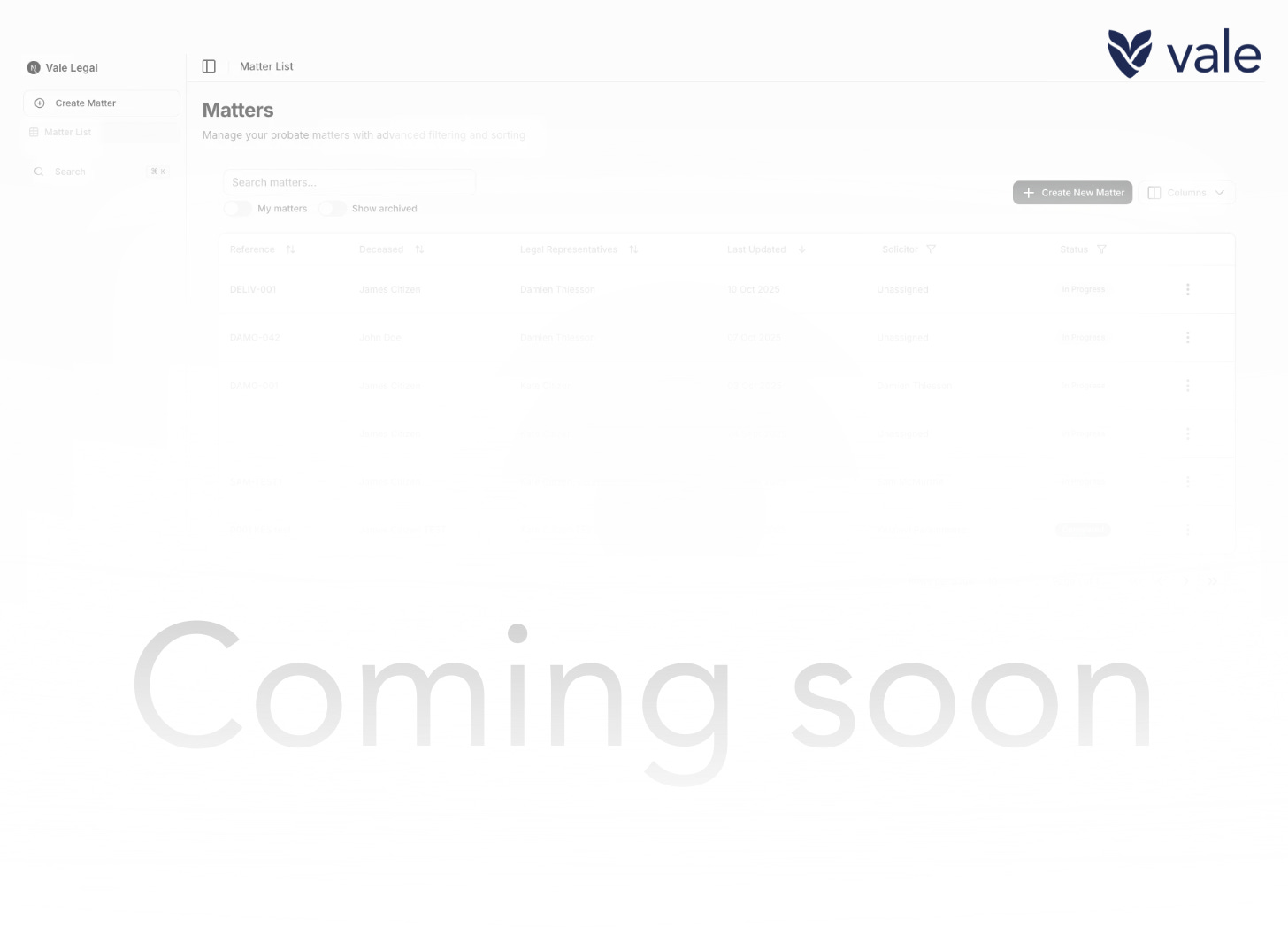

But the feedback was coming faster than we could build. We were learning faster than we could move. It was at this point that we brought in Damien Thiesson, and another senior developer, Sam McMurtrie, to rebuild Vale from the ground up.

By September, the same early firms were using the new product. Faster, sturdier, and built to evolve. Suddenly everything moved differently. Features were shipping in days, not months, and usage began to spike.

This is the version you’ll access when you join the waitlist.

The Shared End

At its core, Vale exists to make the estate administration process easier for law firms and for clients.

Direction, wisdom, and dedication to the provision of quality legal services have never been in short supply in this country. What the development of our Expert Advisory Panel revealed is that progress in legal technology doesn’t come from disruption, but from collaboration; from listening, testing, refining, and building alongside those who understand the work best.

It also offered a glimpse into something essential about the culture of legal practice. Meaningful progress rarely arrives through the imposition of new systems. It’s uncovered through patience, and is revealed by standing beside practitioners, listening closely, testing ideas together, and allowing better ways of working to emerge naturally from the expertise that already exists within the profession.

Every hour spent mapping pain points;

Every frustrating anecdote about lost correspondence or endless certification requirements;

Every suggestion scribbled in Figma and outlined on Post-It notes across our walls;

Every ounce of feedback, kind and brutal;

It’s all now part of our DNA.

The most forward-thinking work in law doesn’t come from speed or scale. It comes from listening—and from the collective willingness to build something that endures.